Or how Keith explained what the Keith-rambolator is. Maybe Keith—Rambolator 6000. Like the 9000 but cheaper and software upgradable. (Dilbert TV Show joke)

If you’ve ever seen a business plan there are usually sections for market analysis. In high school, I received a great grade for a business plan because I used actual market data (Statscan) and basic analysis techniques – in retrospect I had no idea what I was talking about, but it sure looked good to the masses. So I am going to show how to use some “Trolled Data” to make my estimates.

So I like bicycles. However most people have no idea how big the market is for bicycles. I know of several shops that import Chinese frames and rims/ hubs – and they all swear by them. They may carve out a local niche and usually have to eat a frame or some wheels here or there but they stick with it because they luck out of a massive liability lawsuit over dangerous wheels. Wheels are expensive “free speed” – when a shop offers cheap “free speed” it’s tempting. Similar performance, no real R&D and no real liability control. One major injury and the shop shall cease to exist forever. They see a recurring local market that’s accessible and tempting – offer something cheaper that looks the same and people will buy. This is a more natural approach – “I think there is a market and turns out there is”. It’s the gut feeling that a small shop might put into a business plan where they support it with internal sales numbers of Zipp or HED wheels plus Chinese import pricing, etc etc. We aren’t here to debate Chinerello’s and Zip or HEAD Wheels.

Back to the other side of things where I’ve also seen several start-ups try to estimate markets and they do little better than a small bike shop. The reality is that startups are hard and require a lot of guts. When you’re blue ocean the sky’s the limit and the numbers are close to made up. When you’re red ocean it’s quite messy – every investor asks how the pitch guy knows the market.

But what if you need to know something simpler for your blue ocean tech. We use the terms TAM, SAM, and SOM to talk about market for all things. TAM is Total Available Market which is the total market. SAM is Serviceable Available Market or the portion of TAM that your market can reach. SOM or Serviceable Obtainable Market is the portion of SAM that you can reasonably capture. And this is our screeching halt.

You see SOM is that overly optimistic amount you share to investors. You have to estimate realistically how big this is and it’s hard. Blue Ocean tech means your SOM should be close to SAM because you have zero competitors. However, bike frames for instance, there are lots of competitors – each marketing, each adjusting prices, each offering bike shops a reason to buy their bike and sell it to you, the consumer.

From Don Hertzfeld “Rejected”

However, how do you come up with TAM / SAM. The way I’ve seen it done is usually the most non-scientific guesses. The slightly better way is what you’ll normally find inside a Mom and Pop business plan IF they are really good. It’s called “industry expert” and it is by no means accurate, but has to be infinitely better than nothing – kind of by mathematical definition. There are other ways, like IDC provided about smart watches but that gives us TAM and nothing else. This data is still usually an estimate or “trolled” from SEC filings or similar. There are very expensive reports on different industries that definitively state “The Market size for X is Y” and sometimes the only reason you spent 10000 dollars on it is because someone talked to three CEO’s and massaged some numbers.

So I’m going to walk you through the Keith Rambolator 6000 for high end road bikes. Lets assume I have a new sensor that I want to sell to cyclists. Lets say it’s not a powermeter, speed / cadence, heart rate, or any other sensor – it is, in fact, a new sensor that is unproven. Blue Ocean here. My prototypes work, I’m ready for production, and I am testing the market. So we’ll call this the Daedalus Device because it sounds ominous and I’m a huge nerd.

Lets say it’s only good for Road cyclists (I’m cheating, because this example has good data but this will work for other data). Lets also say that it’s for serious training – if you don’t have a training plan or are serious about competition than you likely won’t buy it.

TAM = Road cycling market? Or is it? In my mind it is not. However, in most Startup CEO’s minds yup. The reality is this is the start of massaging data to make things look amazing for pitching to investors. This is my problem – I can’t inflate sales estimates for a performance device, something in the vein of deep section rims, to the casual cyclist. It doesn’t work but that makes TAM much too small for pitch decks. So investors, be wary of the snake oil.

Recently I got a google alert over the Venge Vias recall. Don’t care about the problem and the finger pointing but it provides some cool data. Normally the approximate number of units is reported. In Canada 94 units from July ‘15 to Sept ‘16.

Given this is about 1 year and the population of Canada is roughly 1/10 that of the USA we can estimate that 900 – 1000 units of the Venge Vias was sold there. Why isn’t this an assumption? Well because I can prove it’s right from several reports (such as here) stating that the US recall is “about 1000 units”.

Assumption 1 – Europe has more population but more brand competition. Assume equal market size for twice the population of US (Medium Assumption)

Okay, now I’m making a leap of faith here. I have little basis for this except industry experience (AND NOT “expert opinion” because I’m not, and most people you meet, even CEO’s won’t be – actually mostly the CEO’s won’t be, but someone else in their company is).

Product Assumption 1 – it’s too painful and expensive to access the JP / Aus / Etc market (High Value Assumption)

This is generally legitimate for a North American startup. If it’s electronic you need FCC for US for both passive and active devices. Most places can handle the paperwork for Canada for an additional small fee and a Medium fee for EU. However, it gets a little harder with JP / AUS because most NA houses have less experience with them. Also, the more countries you sell too the more regulations, support, and shipping / logistical nightmares. Limit regions for your startup because really you’re testing the market, not selling a product.

So we can estimate the sales of the Venge Vias at about 2000 units a year (rounding down for Canada).

Assumption 2 – Venge Vias is top tier for Aero Road, so Specialized has Tarmac in top tier that should sell equally as well (Medium assumption)

It’s more likely that this is weak assumption. The Venge Vias is a 6000 – 12000k bike while Tarmac starts much lower at less than 3k. So this is likely conservative.

Assumption 3 – Industry tends to indicate that Ultegra sells about 5:1 over Dura-Ace (as a bike shop, it ranges) (Medium / Weak Assumption)

Okay, so two more assumptions lead us to Specialized selling 2000 Vias, 2000 Tarmac DA, and about 10000 Tarmac Ultegra. I’m going to cut in here about the Product assumption again. There are lower end units but we’re after SAM / TAM. If this becomes SAM then we can inflate for TAM, if this is TAM we could expand.

This is a medium to weak assumption meaning it might be less valid. Companies, especially the big bike companies, constantly look for ways to drive down price. That non matched crankset, it’s not performance, it’s to save a few dollars. No Brand Brakes – yup money savings. Commonly, off brand chains and lower grade cassettes. To me this is bad because they are hiding the cheap components that are harder to see (except the crank). The crank is one of the highest cost components so they have a market spin on this. EG: our house brand crank is better – usually not better, just cheaper. Sometimes better. This serves to do two things for the analysis. It means we’re being conservative, but it also means that while we’re being conservative, the people buying these versions of bikes that are cheaping out are not likely our market for the Daedalus Device.

ASS 4 – Tarmac coexists with Allez and Roubaix, Assume similar volumes as Tarmac Ultegra and NO DA level (Medium Assumption)

So market is up to 34000 units / year. This is probably a medium level assumption because of a few points. It’s the Ferrari theory. To drive a supercar to the edge you should be physically fit, reactive, good eyes, ability to handle vibration BUT the people who can afford these are usually older, fatter, and want comfort. So it’s likely they are more willing to buy Tarmac over Venge, but even more likely to buy Roubaix top level over a mid level Tarmac.

Confirmation Data from Trek Recall

In 2013 there was a Madone Brake Recall due to their in house designed brakes. Not all Madones were affected, but most of the higher end (5.2 and up) were affected. Well, looking at serial numbers affected show 14769 units. Which is about 1.5 times the estimated Tarmac alone (10k – 12k). This is pretty good confirmation because in Ass 5 (below) we use the revenue to pro-rate.

PA 2 – Customers who are Tech Savvy with sensors already / serious athletes. So most of the market is top two tiers

This is sort of a cheat, but I tended to see more people at mid tier (Ultegra and higher) have sensors and most below that without.

ASS 5 / PA 3 – From one, comes many. Lets say my market is mainly road but I need to know how the market grows from one company. Company size and other data

Okay, time to dig into some analysis here

Specialized had 300 employees in 2002 (wiki, unreliable, blah blah). Trek has 1800, but also manufactures stuff on site (Specialized is more Asia) so this might not be useful since a company that manufacters might have 3 – 5 labourers per engineer staff. Instead lets focus on revenue. Specialized sales est. is 600 million, Trek is 900 million. Giant is 1.8 billion, but heavily into manufacturing for other companies. Cervelo is 11 Million. All Wiki, all suspect.

According to NBDA (here) old sample data, there is a “Big three” of bikes: Trek, Specialized, and Giant.

ASS 6 – Giant is more manufacturing NOT sales, therefore Giant < Specialized, therefor assume equal.

So we know estimate that Trek sales of bikes, pro-rated against sales volume of Specialized and annual revenue means. Specialized = 34k, Trek = 51K, and Giant = 34k. Total market is 115k / year for SAM since this is realistically the actual market. It’s not necessarily true though. Depending on perspective as said above, this could actually be TAM (if you’re an engineer) or SAM (if you’re a a not so honest type all the way to greasy CEO type). It all depends. What is the TAM? Will you ever get this level of Assumption detail and explanation?

ASS 7 – SOM from Simon Sinek, “Well you can trip over 10% of the customers” rule. Watch this video.

You need to get the 2.5% early adopters to get the 13.5% to 18% early market in order to trip the system to catching on. So what should your first year SOM be? From an engineering perspective, 2.5% is right, 2nd year 15%. Why? If you can’t achieve the 2.5% in the first year with people who just “get it” then there is not point to fight for 3 or 4% UNLESS you got the market analysis wrong. You need to get the 2.5% so the 13.5% to 18% to see it in the hands of other people. However with hardware this is really hard. I’m not going to change the numbers, but just accept that year 1 might be year 2 or year 3 sales. This is where you can’t tell because you don’t know if the early adopters will “Get it” and pay for it.

So what are my numbers for my Daedalus Device.

3 (4?) TAM SAM SOM Models

ASS 8 – TAM is market including entry level components 105 level. 105 level sells more units than Ultegra but has less tech adoption. Assume 2 – 3 times volume.

So under assumption 8 we could get a conservative model using the 3 times ASS 6 as:

(1) AM = 400k Units, SAM = 115k units, SOM (year 1) = 3000 units, SOM (Year 2) = 17.25k units, SOM (Year 3, achieved tip in Year 3) = 57.5k units.

Weak ASS 9 – Mix wrong data. Lava Magazine Triathlon bike counts indicated Trek and Specialized are maybe 1/4 of the market.

However this goes in the face of the Revenue theory. In Triathlon, Cervelo is actually greater than Trek and Specialized combined for the bike counts. Their revenue is 1/6th of Specialized. But using this we can inflate the numbers by showing that The Big 3 are smaller. This paints a very different picture:

(2) TAM = 1.6 Million, SAM = 460k, SOM = 11.5k (y1), 70k (y2), 230k (y3).

Alternatively, and using NBDA industry overview data here, we could say directly a very simple model. This is what I’ve seen most in Pitch Decks:

(3) TAM = 17.4 Million, SAM = 20% (all road bikes), so 3.5 Million, and SOM = 5% meaning 174k.

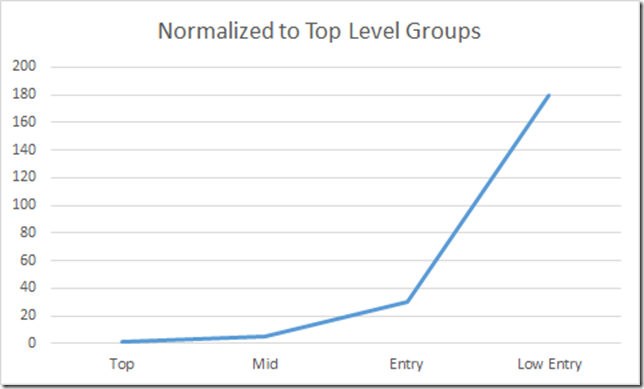

A better estimate through the Keith-Rambolater – these are the instinctive guesses I’ve been called out for on my Apple Watch usage. TAM is only road but also the upper segment but also CAN/USA/EU. This data is US only so we’ll have to double?. Our SAM is the percentage of market here that buy high end equipment. So assuming an exponential curve for Top to Entry and cut at the Low Entry (We have to include this since we are extracting our data from ALL bikes) we can see that maybe 2.7% is in the SAM. Then we can do the same SOM analysis using the Simon Sinek idea of early adopters.

(4) TAM = 6.8 Million, SAM = 180k, SOM = 4.5k (y1), 27k (y2), 90k (y3). Wait a minute! The SAM and SOM numbers look a lot like our 8 Assumption model, though a bit higher. TAM is inflationary because we chose it to be since we were starting with ALL data.

If you haven’t guessed the use of the word “ASS” is a bit intentional by this point. There is a bit of a clear “one of these things is not like the other (maybe two). Keith Rambolator and 8 ASS are close and “8 inflated ASS” is similar, but the NBDA direct data outlies (this is a logarithmic graph so ever line is an order of magnitude). So Year One of Daedalus Device should be around 3 – 11.5k units. If it were to achieve this without significant marketing effort (Lean Startup) then we can say we’ve tested the market and we’re in a good position.

(Anti) Caveat 1 -- DONT EXTRAPOLATE DATA!!!!!!

If you’re an engineer, mathematician, scientist, etc you’ll probably remember someone yelling at you to not estimate outside of the dataset because you don’t know if the relationship you regressed holes true. The reason that Business Analysts get paid so much is because they risk their job on doing what I just did – if they get it wrong they need a new job, if they get it right, they keep their six digit paycheck. However, for the engineer in me it makes me cringe soooooo badly.

Caveat 2 – This actually underestimates (or overestimates?)

Based on some other knowledge I have, this is likely underestimated. Assumptions 2, 3 and 4 are likely the cause of this. Tarmac likely sells better than Venge Vias as the Vias is in a premium range (9k bike when some DA level bikes start around 4k) and I didn’t account for the non Vias Venge either. So this should allow a larger market size for TAM and SAM. Fixing 2 should go a long way to fixing estimates. I don’t have enough data to figure out sales volume of Allez and Roubaix. It’s hard to know as Roubaix has moved upmarket.

Assumption 6 could be better refined. For instance if we could estimate better the road volume segment of Trek and Specialized or add in other large brands.

So what now?

Go, live your life. Know that I am not an expert in anything but know that there are multiple ways to do anything. Aggregate data is your friend though. If you solve a problem 10 ways and 9 of them line up then you know which one is wrong (usually, something about a type 2 error in stats).

This is my problem with comparison. If you have two devices or models of things that are similar you CAN NEVER assume one is right and the other is wrong unless you have some evidence to support. I created 3 – 4 models here and 2 – 3 lined up. One (the most commonly used) was at least one order of magnitude larger. Likely the true numbers probably between the lower 3 models. However, all are based on similar assumptions and each assumption could have wrecked the lower models.

Everything, except the NBDA model, used a simple Product Assumption – it’ll take a year to get your early adopters before you can access your early market and mass market. This is more about what you promise your investors. In Blue Ocean you could in theory access all of SAM but in reality you can’t or won’t. Someone will come behind you. Like Apple came behind HTC with touch phones, and then android came behind Apple’s more refined iOS / iPhone.

In red ocean there is a different approach. Like building a product that already exists – weather it’s to create a new feature or improve the price. Your TAM and SAM might be similar, but you need a different method to determine SOM.